The Pan-African Parliament’s Plenary has given the go-ahead to the Committee on Monetary and Financial Affairs to start crafting Model Laws on Cooperatives and Factoring at the ongoing First Ordinary Session of the Sixth Parliament in Midrand, South Africa.

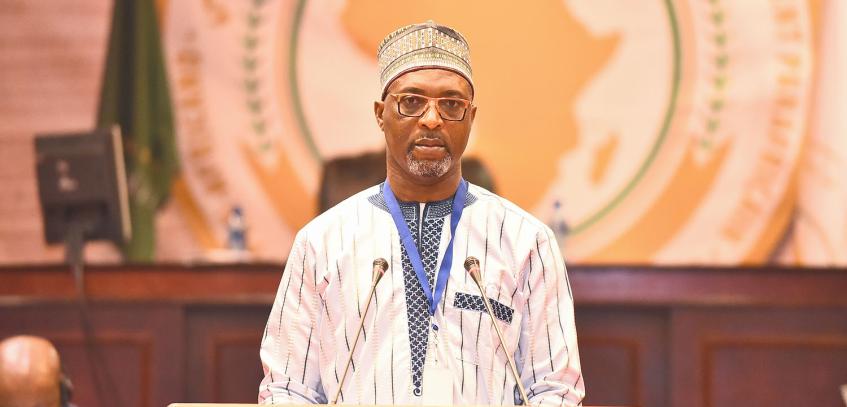

Noting the challenges facing cooperatives in Africa, the Committee on Monetary and Financial Affairs chaired by Hon Mohammed Mubarak Munthaka, sought a mandate from the PAP’s Plenary to formulate a Model legislation that will create a conducive environment for the establishment and growth of cooperatives.

“The challenges facing cooperatives in Africa include overregulation, political interference into cooperative affairs, and the existence of cooperative legislation which does not adhere to the cooperative values and principles. A model law on cooperatives opens up the possibility for a new Continental instrument which could expressly acknowledge and promote the relevance of cooperatives in socio-economic development in Africa, and the obligations of States and other stakeholders, specific to cooperative development. This can be another crucial step, given that cooperatives continue to significantly contribute to the achievement of the aspirations of Agenda 2063 of the African Union and other Continental development goals in a manner that ensures prosperity is broadly shared,” reads part of the report presented by Hon Mohammed Mubarak Munthaka.

The highest decision-making body of the PAP authorized the Committee on Monetary and Financial Affairs to ensure that the relevant departments of the African Union Commission, Regional Economic Communities, and civil society organizations are meaningfully involved in the formulation process of the model law on Cooperatives.

Meanwhile, the Committee on Monetary and Financial Affairs was also mandated to develop a Model Law on Factoring in Africa. Factoring is defined as an arrangement where the seller assigns to the factor, receivables arising from the contract of sales of goods or services. The factor is required to provide at least two of the following; finance to the seller, maintenance of accounts relating to the receivables, collection from the buyer or protection against default in payment by the buyer.

Hon Mohammed Mubarak Munthaka, in his report, said having a Model Law on Factoring will address the financing gap, particularly for Small and Medium-Sized Enterprises (SMEs) as it would help innovative enterprises to grow through trade development and advance the implementation of the Africa Continental Free Trade Agreement for Africa’s structural transformation.

-Ends-